can you buy a house if you owe state taxes

But making the process as seamless as possible will require strategic planning on your behalf. Unfortunately providing recent W-2 returns verifying your income becomes impossible to do if you havent filed your taxes.

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Can you buy a home if you havent filed taxes.

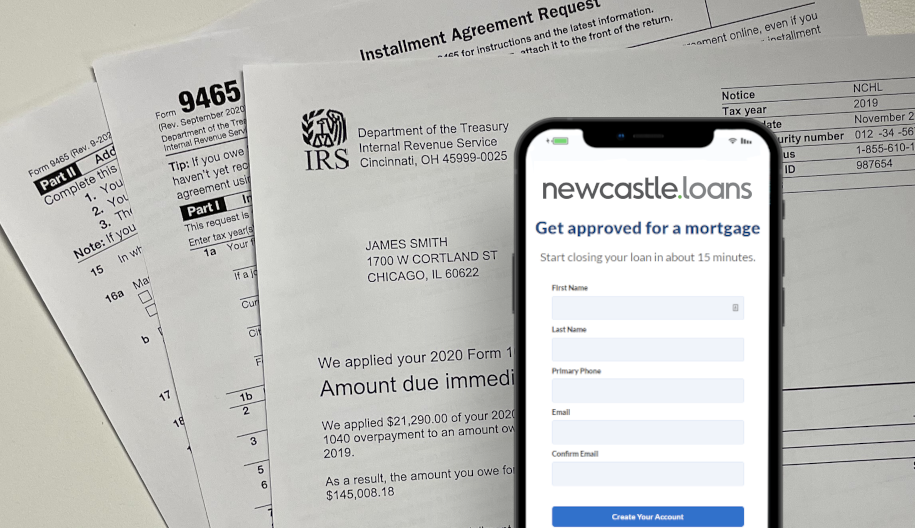

. Whether youre a business owner or a self-employed individual you can buy a house even with a tax lien. Yes you can sometimes get the loan that you need to buy a home even if you have a tax debt and owe taxes. Owing the IRS can lead to a tax lien Owing back taxes to the Internal Revenue Service can make the commission slap a lien on your property.

Yes you might be able to get a home loan even if you owe taxes. As tempting as it is to put your head in the sand when you. The difference in the type of lien you have on your property is entirely dependent on where you owe your taxes.

So can you buy a house if you owe state or federal taxes. In New York the state charges 4 percent sales tax with an additional maximum of 475 percent for local county or city tax. Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage.

If youre considering waiting to apply for a mortgage until your IRS or state tax debt is paid off that may not be necessary. When tax liens are involved it can make the process a stressful one. Now some people think These taxes are not due yet so I dont owe.

For unpaid state taxes. If you owe other kinds of taxes like property tax or state tax you might still be able to get approved for a mortgage. Fortress Tax Relief has.

You might not get very far with the mortgage application process if you have unfiled tax returns in your recent history. If you buy a vehicle outside of your own state you will pay the sales. Once you have filed your current taxes you can go online and request an installment agreement if your tax liability is under 50000.

You can deduct up to 250000 of your capital gains. If it is over 50000 you can still. The key to getting over this hurdle is communication.

Many states have short deadlines to pay before they file a lien or lien equivalent so state tax debt can quickly affect your ability to borrow. The good news is you can buy a house even if you owe tax debt. Its still possible but youll be seen as a riskier borrower.

If you do not meet the requirements you will owe capital gain taxes on the new house you purchase. They are not due yet. To understand how owing the IRS affects buying a.

The last thing you want to do is invest in a home only to have to forfeit it to the IRS. A tax lien represents the governments legal claim. Avoiding an IRS lien.

If you owe taxes and are wanting to purchase a home or if you simply wish to learn the best way to go about resolving your tax liability give us a call. Have you found yourself wondering If I owe taxes can I still buy a house. Well begin by answering your key question.

But if you owe back. For federal taxes the lien will be issued from the IRS. Answer 1 of 4.

If youre looking to buy a house while you have a federal tax debt you may have a more difficult time getting a mortgage. In general your likelihood of being approved for a home loan. Today is March 11.

Lets say you owe the state 1000 in taxes payable April 15. If youre not ready to give up on the house of your dreams call SH. Generally lenders request W-2 forms going back at.

While homeownership is a goal for many people owing taxes to the IRS can make. If your house is worth more than the taxes and selling the property will pay off the full amount of the taxes the sale of your house or property will most likely be allowed.

10 Tax Benefits Of Owning A Home Forbes Advisor

Selling A Home Capital Gains Exclusion Phoenix Tucson Az

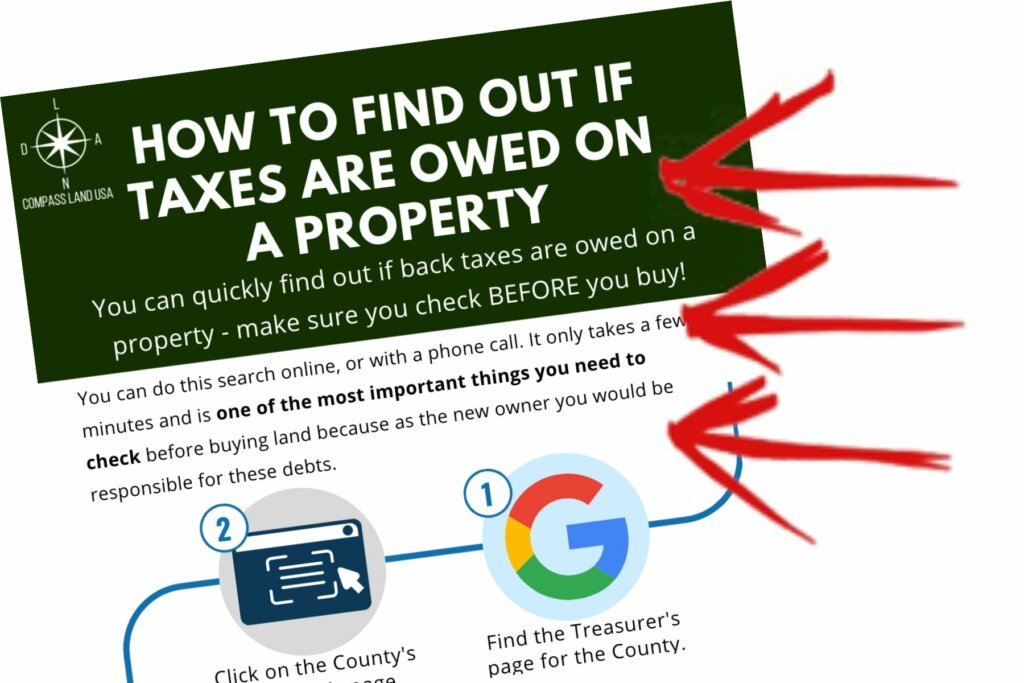

How To Check For Property Back Taxes And Liens For Free In 2020 Compass Land Usa

Is It Possible To Buy A House If I Owe Back Taxes

Is It Possible To Buy A House If I Owe Back Taxes

Guide To Taxes On Selling A House Smartasset

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs

How Much Tax Do You Pay When You Sell A Rental Property

How To Pay Little To No Taxes For The Rest Of Your Life

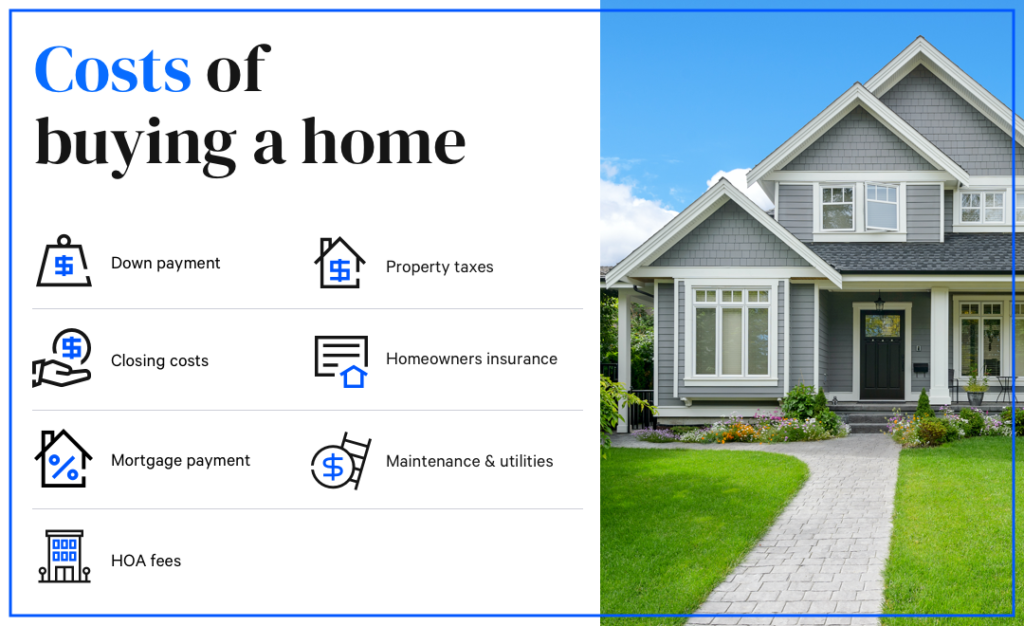

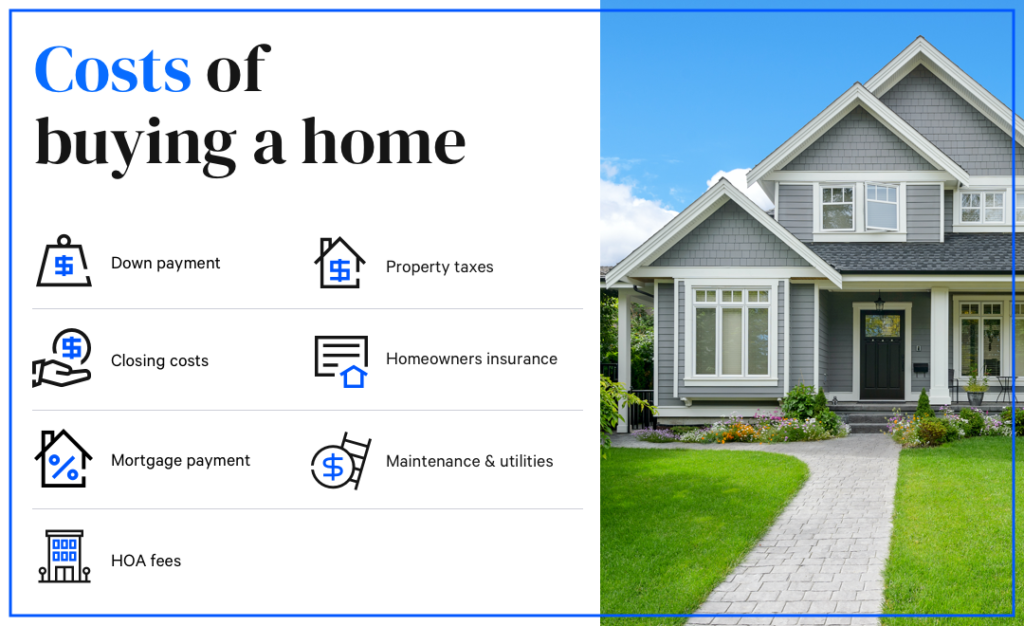

How Much Money Do You Need To Buy A House Bankrate

Can You Buy A House If You Owe State Taxes Quora

Property Tax How To Calculate Local Considerations

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Property Taxes And Your Mortgage What You Need To Know Ramsey

How Short Sales And Foreclosures Affect Your Taxes Turbotax Tax Tips Videos

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

Medicaid Debt Can Cost You Your House The Atlantic

Can You Avoid Capital Gains By Buying Another Home Smartasset